Amidst sharp volatility, the benchmark index, NSE NIFTY, ended last trading session of the weak with minor gain.

NIFTY, after opening the session around the level of 8,929 mark, rose to an intraday high of 8,958 before slipping to a low of 8,849 and finally ending the trade with the gain of just 15 odd points at 8,938 mark.

- Nifty had a volatile trading session which ended flat.

- Nifty added 15 points to close at 8937.

- OI concentration is seen at 8500 PE and 9000 CE.

- Addition witnessed in 9000CE and in 8900PE.

- PCR OI stands at 1.15 compared to 1.12 in the previous trading session.

- Nifty to trade with a support of 8830.

Sectorally, it remained a mixed day of trade with CNX Pharma emerging as top gainer once again, up 2.5% while on other hand, CNX Metal, emerged as top loser down 1.8%.

Broader market indices like CNX Mid-cap and Smallcap ended the trade with gain of about 0.8% and 1.2% each respectively.

Sectoral Activity: Amongst sectoral index, CNX Pharma adds fresh long position.

Stock Activity:

- UBL and Divis Lab observed build up in long position.

- Hindunilvr and Pharma stocks aided Nifty to close in the green.

- In the Banking space, Indusind bank trades with a support of 890 levels.

- The stock has bounced back from these levels. The stock remains positive above this. The RSI and MACD also indicate a positive bias. We expect the stock to rise from current levels.One can accumulate the same at current levels for a near term target of 950 and higher.

- Market wide open interest is seen at Rs.221,048cr.

Indication & Outlook

Put Call Ratio based on Open Interest of Nifty moved up from 0.96 to 0.98 levels compared to previous trading session. Historical Volatility of Nifty fell down from 18.01 to 17.55 levels and Implied Volatility also fell down from 14.47 to 14.04 levels.

Future Short Term Call

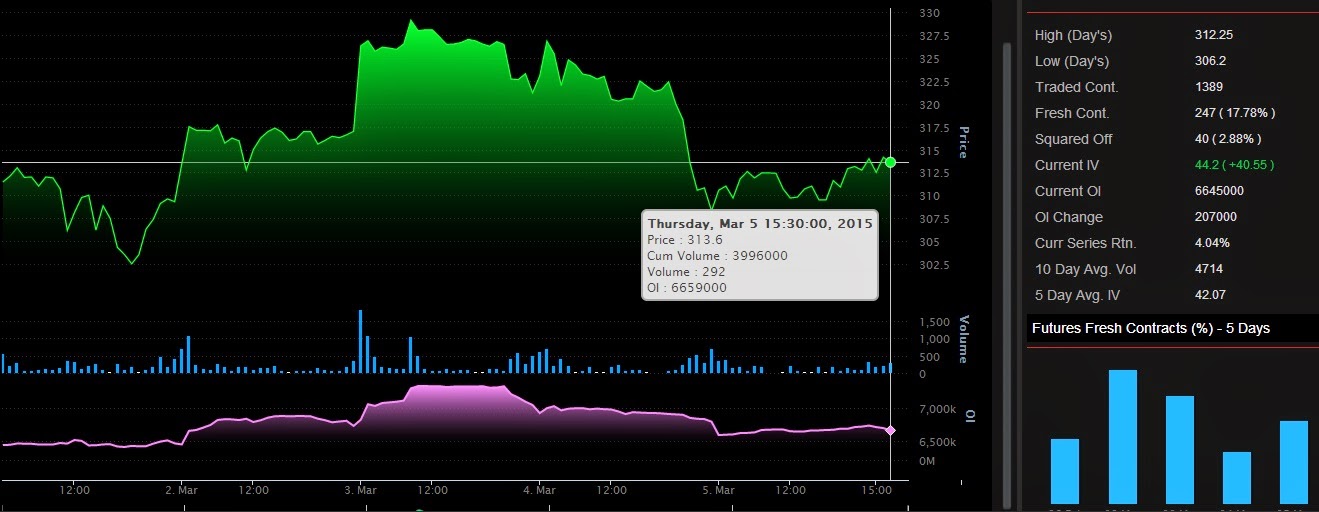

ARVIND is moving from last three series and making higher top- higher bottom formation. Overall long term trend is positive in the stock and after the recent consolidation it is again set to move upwards.

It traded in previous day’s range and managed to hold the gains even after pressure in the broader market and witnessing built up of long position thus forming an attractive price pattern.

Traders can buy the stock with stop loss of 303 for the upside target of 315 levels.

Buy Between Rs. 308 to Rs. 311, Stop Loss 303, Target 322

HINDALCO has been falling from last two trading session as failed to hold its crucial hurdle of 160 zones.

It witnessed built up of short position and taken out the positive move of last five trading session and closed near to three weeks lower levels. It has immediate support at 140 and holding below may attract fresh selling pressure in the counter.

One can sell with a stop loss of 155 for the down side target of 146 levels.

Sell Between Rs. 151 to Rs. 153, Stop Loss 155, Target 146

No comments:

Post a Comment